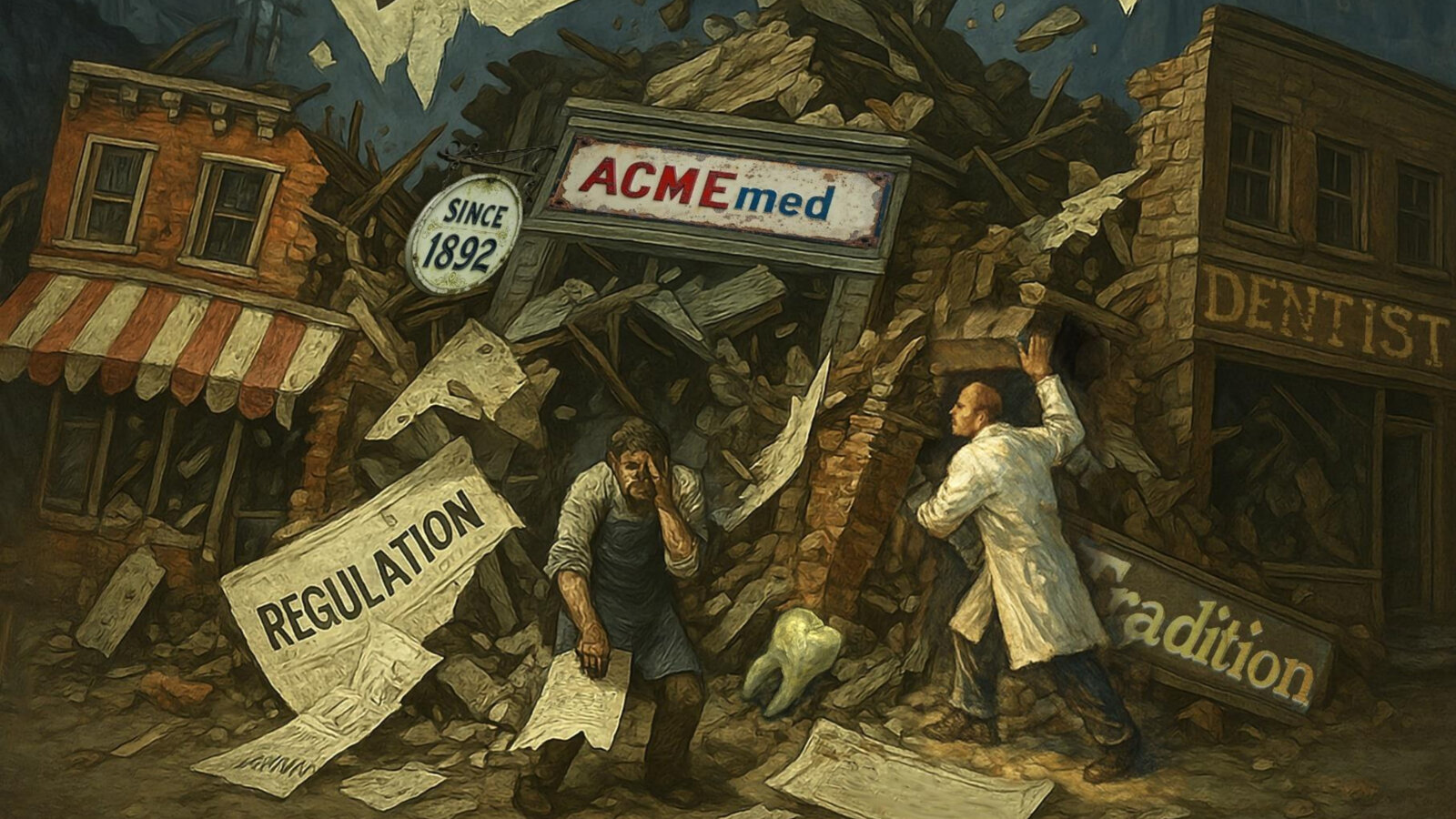

BERLIN, Germany: Five years into its application, the EU Medical Device Regulation 2017/745 (MDR) is reshaping how medical and dental devices reach patients across Europe; however, critics say the regulation is unintentionally undermining exactly what it set out to protect: safe medical devices and a strong and innovative European medical device industry. A new report published by industry insiders outlines where the MDR is falling short and how it could be fixed.

According to the report, titled “Safeguarding supply security in Europe and European competitiveness”, since 2014, Germany has lost more than 10,000 mostly micro and small medical device manufacturers. Companies like these represent around 99% of the market, but their share of total turnover has dropped from about 75% to just over 36%. Furthermore, the report highlights that many smaller manufacturers have shut down or left the industry altogether, and that larger firms have discontinued less profitable product lines.

For dental practices, this translates into vanishing dental materials, reduced choice and the risk of treatment gaps when long-established products are no longer available. The report stresses that this trend began prior to the COVID-19 pandemic and is closely linked to MDR recertification rules.

Under the MDR, notified bodies sample only a small share of product files in large companies, whereas small- and medium-sized enterprises with few products often face full recertification in a single cycle, sometimes with the same file re-examined year after year at full cost. Audit time per employee is dramatically higher for smaller enterprises. The report cites the example of Dentaurum, a dental company founded in southwestern Germany in 1886. The company has already removed around 1,000 products from its range owing to the MDR.

Yvonne Hoffmann, management executive at Germany-based Hoffmann Dental Manufaktur and co-author of the report, pointed out that her company had withdrawn Proxifungine from its portfolio. Sales of the long-standing class III Medical Device were discontinued owing to the high cost of re-registering the device. “Other products might follow at the end of the transition period at the end of 2028,” Hoffman told Dental Tribune International. Beyond discontinuing product lines, for true micro-enterprises, the choice is frequently binary: close, or abandon medical devices for a less regulated field.

“Given the loss of numerous small suppliers, we are also losing resilience.”—Yvonne Hoffmann, Hoffmann Dental

Meanwhile, the framework for distributors is reported to be weak. Many distributors are not registered as economic operators anywhere in Europe, yet they sell high-risk or non-compliant products online across borders, including to laypersons. This creates unfair competition for compliant manufacturers and risks to patient safety.

Hoffman stressed that manufacturers are being confronted with excessive demands regarding documentation and clinical studies, and that the risks posed to Europe’s dental manufacturing industry by the MDR are twofold: “On the one hand, as we lose safe medical devices, the ultimate risk is to patient safety. Additionally, given the loss of numerous small suppliers, we are also losing resilience.” She emphasised in the report that her family’s business has survived two world wars, numerous financial crises and the COVID-19 pandemic “and is now acutely threatened by the MDR”.

Three proposed MDR fixes

The report proposes three ad hoc actions. These could be implemented quickly and at very low cost:

- Create a new “Class I Legacy” for well-established technology devices. Legacy devices with at least ten years of safe use under the old Medical Devices Directive would be regrouped into a new low-risk class. They would be exempt from costly notified body recertification, but still fully subject to post-market surveillance by national authorities.

- Use Article 97 MDR proactively for smaller businesses. The authors urge the European Commission to allow derogations under MDR Articles 59 and 97 to extend the transition period for smaller EU-based businesses producing safe legacy devices. This would give health authorities a stronger role in keeping proven devices available while smaller businesses complete conformity assessments.

- Make distributor registration in the European database on medical devices mandatory. All distributors should be centrally registered under Article 31 in the European medical device database, just like manufacturers and importers. Technically, this would require only a new identification range but would greatly improve traceability in cross-border e-commerce and make it harder for unsafe, mislabelled or non-CE-marked products to reach the market.

Hoffman told DTI that concerted changes such as creating a separate legacy class for well-established technologies would be a great leap forward and could save Europe’s medical device industry from an uncertain future. The report concludes that, without smart, targeted changes to the MDR, Europe risks losing innovative family-owned manufacturers and the proven materials that underpin routine dentistry.

The report has been endorsed by The Association of Dental Dealers in Europe and the Bundesverband Dentalhandel, a German union of dental distributors. A copy of the document can be accessed here.

Tags:

Austria / Österreich

Austria / Österreich

Bosnia and Herzegovina / Босна и Херцеговина

Bosnia and Herzegovina / Босна и Херцеговина

Bulgaria / България

Bulgaria / България

Croatia / Hrvatska

Croatia / Hrvatska

Czech Republic & Slovakia / Česká republika & Slovensko

Czech Republic & Slovakia / Česká republika & Slovensko

France / France

France / France

Germany / Deutschland

Germany / Deutschland

Greece / ΕΛΛΑΔΑ

Greece / ΕΛΛΑΔΑ

Hungary / Hungary

Hungary / Hungary

Italy / Italia

Italy / Italia

Netherlands / Nederland

Netherlands / Nederland

Nordic / Nordic

Nordic / Nordic

Poland / Polska

Poland / Polska

Portugal / Portugal

Portugal / Portugal

Romania & Moldova / România & Moldova

Romania & Moldova / România & Moldova

Slovenia / Slovenija

Slovenia / Slovenija

Serbia & Montenegro / Србија и Црна Гора

Serbia & Montenegro / Србија и Црна Гора

Spain / España

Spain / España

Switzerland / Schweiz

Switzerland / Schweiz

Turkey / Türkiye

Turkey / Türkiye

UK & Ireland / UK & Ireland

UK & Ireland / UK & Ireland

Brazil / Brasil

Brazil / Brasil

Canada / Canada

Canada / Canada

Latin America / Latinoamérica

Latin America / Latinoamérica

USA / USA

USA / USA

China / 中国

China / 中国

India / भारत गणराज्य

India / भारत गणराज्य

Pakistan / Pākistān

Pakistan / Pākistān

Vietnam / Việt Nam

Vietnam / Việt Nam

ASEAN / ASEAN

ASEAN / ASEAN

Israel / מְדִינַת יִשְׂרָאֵל

Israel / מְדִינַת יִשְׂרָאֵל

Algeria, Morocco & Tunisia / الجزائر والمغرب وتونس

Algeria, Morocco & Tunisia / الجزائر والمغرب وتونس

Middle East / Middle East

Middle East / Middle East

To post a reply please login or register