Dentsply Sirona

Dentsply Sirona competes across all major dental imaging segments and continues to strengthen its comprehensive portfolio. In 2024, the company launched the Primescan 2 intra-oral scanner in combination with the DS Core cloud platform, followed by AI-powered caries detection and further software enhancements in 2025. In intra-oral radiography, the Heliodent Plus generator is combined with the Schick digital intra-oral sensor line, including the Schick 33 and Schick AE sensors.

In the extra-oral segment, Dentsply Sirona offers the Orthophos line of panoramic units. The Orthophos S and Orthophos SL models are available in both 2D panoramic and CBCT configurations, and the portfolio is complemented by the high-end Axeos CBCT scanner. Dentsply Sirona has also collaborated with Siemens Healthineers to develop the MAGNETOM Free.Max Dental Edition, an MRI system designed for dental and maxillofacial diagnostics.

DEXIS

DEXIS plays a significant role in digital imaging and is expanding its digital ecosystem. Following the acquisition of Carestream Dental’s intra-oral scanner business, the company launched the wireless DEXIS Imprevo intra-oral scanner last year.

In extra-oral imaging, DEXIS markets the ORTHOPANTOMOGRAPH OP 3D lines, including the EX and LX models. These are complemented by the i-CAT FLX V-Series, which provides a premium CBCT option for advanced 3D imaging indications. In intra-oral radiography, it offers the DEXIS Ti2 intra-oral sensor and the NOMAD Pro 2 handheld intra-oral radiography unit.

Planmeca

Planmeca remains a powerhouse in digital imaging. Last year, the company introduced the Planmeca Viso G1 CBCT unit, which combines high-end 3D imaging with the Planmeca Ultra Low Dose protocol and the Planmeca CALM algorithm for patient movement artefact correction.

Also last year, Planmeca added the Planmeca ProX GO handheld device to its intra-oral radiography portfolio, which includes the wall-mounted Planmeca ProX radiography unit and the Planmeca ProSensor HD digital intra-oral sensors. These imaging devices are tightly integrated with the Planmeca Romexis 7 software platform, which embeds AI tools for anatomy recognition, tooth numbering and implant planning.

Vatech

Vatech is another key participant in the dental imaging arena. Its extra-oral portfolio includes the Green X and Green CT lines. The Green X 18 is its flagship four-in-one digital radiography system, combining panoramic, CBCT, cephalometric and model scanning capabilities.

For intra-oral imaging, Vatech offers the EzSensor line (EzSensor Classic and EzSensor P), complemented by the EzRay Air series of intra-oral radiography generators and the EzScan intra-oral scanner.

Conclusion

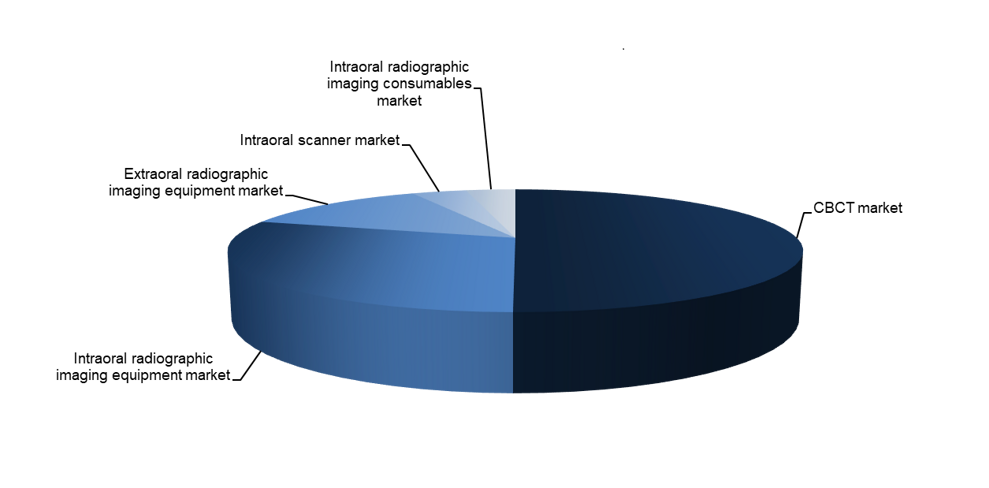

The dental imaging market in the Middle East is poised for continued growth, driven by strong demand for digitisation and modernisation that enhances both diagnostic accuracy and workflow efficiency. AI is set to play a central role in device innovation, from acquisition and reconstruction to diagnosis and workflow orchestration, improving clinical productivity and supporting a more comfortable experience for patients. Combined with the aggressive product development and marketing strategies of major competitors, these technological advances are expected to be key drivers of market growth and transformation in the coming years.

Austria / Österreich

Austria / Österreich

Bosnia and Herzegovina / Босна и Херцеговина

Bosnia and Herzegovina / Босна и Херцеговина

Bulgaria / България

Bulgaria / България

Croatia / Hrvatska

Croatia / Hrvatska

Czech Republic & Slovakia / Česká republika & Slovensko

Czech Republic & Slovakia / Česká republika & Slovensko

France / France

France / France

Germany / Deutschland

Germany / Deutschland

Greece / ΕΛΛΑΔΑ

Greece / ΕΛΛΑΔΑ

Hungary / Hungary

Hungary / Hungary

Italy / Italia

Italy / Italia

Netherlands / Nederland

Netherlands / Nederland

Nordic / Nordic

Nordic / Nordic

Poland / Polska

Poland / Polska

Portugal / Portugal

Portugal / Portugal

Romania & Moldova / România & Moldova

Romania & Moldova / România & Moldova

Slovenia / Slovenija

Slovenia / Slovenija

Serbia & Montenegro / Србија и Црна Гора

Serbia & Montenegro / Србија и Црна Гора

Spain / España

Spain / España

Switzerland / Schweiz

Switzerland / Schweiz

Turkey / Türkiye

Turkey / Türkiye

UK & Ireland / UK & Ireland

UK & Ireland / UK & Ireland

Brazil / Brasil

Brazil / Brasil

Canada / Canada

Canada / Canada

Latin America / Latinoamérica

Latin America / Latinoamérica

USA / USA

USA / USA

China / 中国

China / 中国

India / भारत गणराज्य

India / भारत गणराज्य

Pakistan / Pākistān

Pakistan / Pākistān

Vietnam / Việt Nam

Vietnam / Việt Nam

ASEAN / ASEAN

ASEAN / ASEAN

Israel / מְדִינַת יִשְׂרָאֵל

Israel / מְדִינַת יִשְׂרָאֵל

Algeria, Morocco & Tunisia / الجزائر والمغرب وتونس

Algeria, Morocco & Tunisia / الجزائر والمغرب وتونس

Middle East / Middle East

Middle East / Middle East

To post a reply please login or register